Accounts Payable Payment

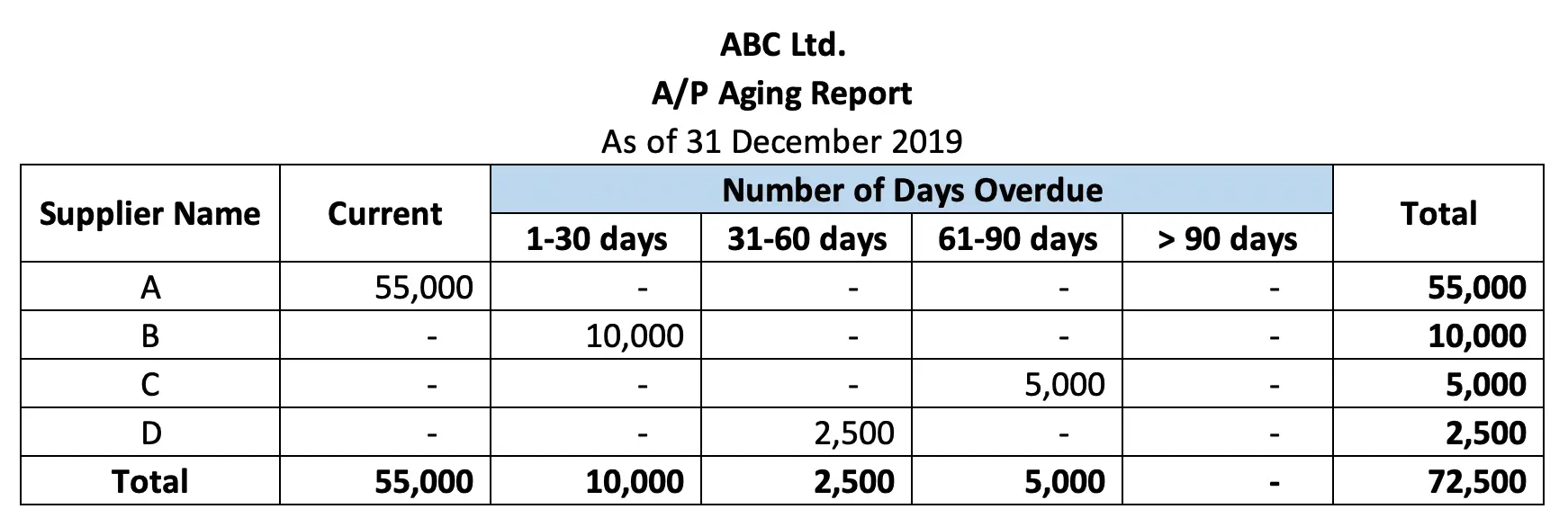

A bill or invoice from a supplier of goods or services on credit is often referred to as a vendor invoice. The vendor invoices are entered as credits in the Accounts Payable account, thereby increasing the credit balance in Accounts Payable. When a company pays a vendor, it will reduce Accounts Payable with a debit amount. As a result, the normal credit balance in Accounts Payable is the amount of vendor invoices that have been recorded but have not yet been paid. In this section, we will explain the recording of AP journal entry in your accounting books. Whenever a company has purchased any goods or services from vendors on credit, they need to record AP journal entry in their accounting books.

Top accounting challenges in 2024

The dollar amount of the accrual is based on factors like the amount of unused vacation time and each employee’s compensation. Accurately calculating this amount is key for representing your financial obligations correctly. Consider using a payroll system or spreadsheet to track and calculate these accruals.

Accounts payable reports worth knowing

Most of the balance on a five-year loan, for example, is categorized as a long-term (noncurrent) liability. The crediting and debiting of each account negates any sample business budget template for income and expenses change in balance between the two transactions. Between the purchase and payment, the credits and debits offset each other and the balance is reduced to zero.

- To ensure consistent and accurate financial information, a dependable accounts payable process is vital.

- It usually contains information regarding the amount that the buyer has to pay and the due date.

- The owner or someone else with financial responsibility, like the CFO), approves the PO.

- However, services related to the direct business operations will be recorded in the accounts payable section and others in the trades payable sub-section.

Vendor Profile Management

Additionally, some states have specific requirements for accrual rates or payouts upon termination. Staying informed about the specific regulations in the states where your employees work is essential for accurate accounting and compliance. Check your state’s Department of Labor website or consult with legal counsel specializing in employment law for more information. Understanding both FASB guidelines and state-specific rules is crucial for accurate and compliant accounting for accrued vacation. This ensures your financial records reflect the true cost of employee vacation time and keeps your business legally sound. Accounts Payable journal entry is the method of recording payables data in the general ledger.

Everything to Run Your Business

The accounts payable turnover ratio measures how many times your business pays its creditors over an accounting period. To calculate the accounts payable turnover ratio, you divide net credit purchases by average accounts payable. With a transparent and reliable accounts payable workflow process, businesses can ensure finances are properly managed and relationships with vendors and suppliers are maintained. Thanks to the advent of accounting software, this process is much easier than it was in the past. Examples of accounts payable include expenses related to goods and services purchased by the business. Think equipment purchases, cleaning services, staff uniforms, software subscriptions, office supplies, and much more.

Accrual vs Cash Basis Accounting Journal Entries

Accounts payable is a liability account, similar to accrued expenses, customer deposits, or interest payable. In case a business received damaged goods, it can return and record such entries against accounts payable as well. The company will create a new allowance for returned goods account to record such transactions. The management will assign accounts payable to its sub-sections and plan for the payment terms. The invoices can include purchases for inventory, office supplies, services received, and so on. Generally, any short-term business obligations can be categorized under the accounts payable account.

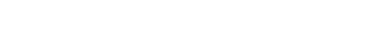

Accounts payable automation refers to tools or processes that allow you to eliminate the manual aspects of AP, such as manual tracking of purchase invoices, bills, etc. Accounts payable automation software or AP automation software allows you to automate the entire process by online submission and approval of purchase orders and purchase invoices. Accounts payable aging schedule shows you the list of all suppliers with the payback period. Also, the aging schedule highlights late payments to avoid late payment charges by vendors. Automated Payments Reminders will help you to avoid late or missed payments. Also, you can take advantage of discounts and negotiate the credit terms with your vendors for future purchases.

When you receive the invoice, you will record it as an accounts payable in your financial books, because this money you owe to CDE company for goods purchased on credit. Accounts Payable (AP) is an accounting term that refers to money owed to suppliers, vendors, or employees for goods or services purchased on credit. Proper double-entry bookkeeping requires that there must always be an offsetting debit and credit for all entries made into the general ledger. To record accounts payable, the accountant credits accounts payable when the bill or invoice is received. At the corporate level, AP refers to short-term payments due to suppliers. The payable is essentially a short-term IOU from one business to another business or entity.

İLETİŞİM :

BAĞLANTILAR

Kullanım Koşulları · Gizlilik Politikası

© Copyright 2020 Kaş Ajans